Anúncios

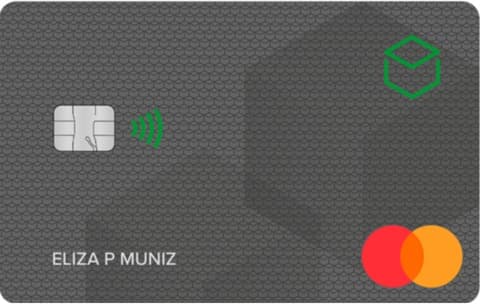

With zero annual fees, international acceptance, and a powerful mobile app, it offers full control over your finances while helping you save money.

Disclaimer: You will be redirected to the official website.

Benefits of the Banco Original Card

The Banco Original Credit Card provides a range of advantages, making it an excellent choice for those who want a hassle-free, cost-effective credit solution. Here are its top benefits:

- No Annual Fee – Enjoy a credit card with zero monthly charges.

- Cashback on Every Purchase – Get money back on all transactions, credited directly to your account.

- Complete Financial Management via App – Monitor bills, spending limits, and rewards in real-time.

- Virtual Card for Online Purchases – Extra security for digital transactions.

- International Purchases – Accepted worldwide on Mastercard and Visa networks.

- Exclusive Discounts – Special offers at partner retailers and loyalty programs.

- Emergency Cash Withdrawals – Withdraw money from ATMs whenever needed.

- Contactless Payments – Faster, more secure transactions with tap-to-pay technology.

Watch the Video

Pros

- Permanent annual fee exemption, ensuring long-term savings.

- Guaranteed cashback on all purchases, providing direct financial returns.

- User-friendly mobile app with complete spending control.

- Global acceptance, ideal for international travelers.

- Virtual card for online security, reducing fraud risks.

Cons

- Initial credit limit may be low, depending on credit evaluation.

- Cashback percentage varies by card type, with higher-tier cards offering better rewards.

- Late payment fees and high interest rates can apply if the bill is not paid on time.

about the card

The Banco Original Credit Card was designed to provide maximum convenience and real financial benefits to its users. Its biggest advantage is the combination of zero annual fees and a cashback program, which gives cardholders money back on every purchase.

Additionally, Banco Original has invested heavily in technology, offering a fully digital banking experience. With its intuitive mobile app, customers can track transactions, adjust limits, pay bills, and redeem cashback rewards seamlessly.

Unlike many credit cards that charge hidden fees and unclear interest rates, the Banco Original Credit Card prioritizes transparency, allowing customers to better manage their spending without surprises at the end of the month.

Whether you need a card for daily expenses, international transactions, or online shopping, the Banco Original Credit Card is a smart choice for digital-savvy consumers.

How to Apply for the banco original card

Applying for the Banco Original Credit Card is entirely online and takes just a few minutes.

APPLICATION REQUIREMENTS

- Must be at least 18 years old.

- Have a valid CPF (Brazilian taxpayer ID).

- Open a free Banco Original digital account.

- Pass the bank’s credit analysis.

STEP-BY-STEP APPLICATION PROCESS

- Download the Banco Original app or visit the official website.

- Open a free digital account (if you don’t already have one).

- Fill out the application form with your personal and financial details.

- Upload the required documents (ID, CPF, and proof of income).

- Wait for the credit analysis and approval.

- Once approved, your card will be mailed to you.

📌 Tip: A good credit history increases your chances of approval and a higher credit limit.

Disclaimer: You will be redirected to the official website.

CASHBACK & TRANSPARENT FEES

The Banco Original Credit Card is one of the few on the market offering both zero annual fees and cashback. Unlike many competitors with hidden fees, Banco Original provides clear, fair pricing so you can manage your finances with confidence.

With competitive interest rates and a straightforward rewards system, Banco Original is an excellent option for those who want to earn money back while using their credit card.

If you’re looking for a modern, financially rewarding card with full transparency, the Banco Original Credit Card is a top contender.

BANCO ORIGINAL CREDIT CARD FEES & RATES

Before applying, it’s important to understand the card’s fees.

| Fee Type | Banco Original |

|---|---|

| Annual Fee | None |

| Late Payment Interest | From 10% per month |

| Installment Fees | Variable, based on contract terms |

| Cash Advance Fee | Depends on amount and ATM network |

📌 Tip: Always pay your bill on time to avoid unnecessary interest charges and maintain a healthy credit score.

How to Improve Your Credit Score to Get Approved for the banco original CARd

A strong credit score can help you secure higher limits and better financial opportunities. Follow these essential tips to boost your creditworthiness:

✔ Always pay your bills on time – Avoid late payments that negatively affect your score.

✔ Use no more than 30% of your credit limit – Low credit utilization improves your rating.

✔ Avoid multiple credit applications at once – Too many inquiries can lower your score.

✔ Maintain long-term financial accounts – A strong account history builds trust with banks.

✔ Regularly monitor your credit score – Check your rating on Serasa, Boa Vista, or SPC.

📌 Tip: Following these strategies can increase your chances of credit limit increases and premium financial benefits.

FINAL CONSIDERATIONS

The Banco Original Credit Card is an excellent choice for anyone looking for a digital-first, no-fee, cashback-earning credit card.

With zero annual fees, an intuitive mobile app, and money-back rewards, it offers a modern banking experience tailored for financially conscious consumers.

For those who value efficiency, savings, and financial control, this card provides one of the best digital banking solutions available today.

However, it’s important to be mindful of late payment fees—to fully enjoy the benefits, always pay your bill on time and manage your spending wisely.

If you’re looking for a credit card that offers technology, real rewards, and full transparency, the Banco Original Credit Card is a top-tier option.