Anúncios

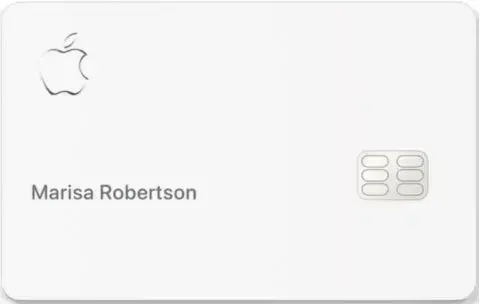

It offers a unique combination of simplicity, transparency, and privacy, making it an appealing choice for tech-savvy users.

Disclaimer: You will be redirected to the official website.

Benefits of Apple Card

- Daily Cash Rewards: Earn unlimited 3% Daily Cash on purchases from Apple, 2% with Apple Pay, and 1% on other purchases.

- No Fees: No annual, foreign transaction, late, or over-limit fees.

- Enhanced Privacy and Security: Built with privacy in mind, the Apple Card does not share your data with third parties for advertising.

- Simple Management: Track spending and manage payments directly from the Wallet app.

- Interest Transparency: Offers clear insights into interest payments before you pay.

Watch the Video

Pros

- No fees of any kind, including foreign transaction fees.

- Daily Cash rewards offer instant value on everyday spending.

- Seamless integration with Apple Pay for contactless transactions.

- Privacy-first design ensures personal data isn’t shared with advertisers.

- User-friendly spending insights in the Wallet app.

Cons

- Limited Rewards Categories: Highest rewards are limited to Apple and select merchants.

- Requires Apple Pay for 2%: Physical card purchases earn only 1%.

- Apple Ecosystem Dependency: Full features require an Apple device.

- No Welcome Bonus: Lacks an introductory reward for new users.

- Good Credit Required: Approval generally requires a strong credit score.

about the card

The Apple Card stands out for its emphasis on simplicity, transparency, and enhancing everyday spending. Designed to integrate seamlessly with Apple Pay, it offers a modern and intuitive credit card experience. With Daily Cash rewards, cardholders earn back on their purchases instantly, providing immediate value with every transaction. This straightforward rewards system makes it particularly appealing for those who frequently use Apple Pay.

One of the card’s key advantages is its no-fee policy, which includes no annual fees, no late fees, and no foreign transaction fees, making it a cost-effective choice for both domestic and international use. The Apple Card’s robust management features, accessible through the Wallet app, provide users with real-time spending insights, payment reminders, and easy control of their finances, setting a new standard for digital credit card management.

Security and privacy are at the forefront of the Apple Card’s design. With features like advanced encryption, dynamic security codes, and the guarantee that your data is not sold to advertisers, the card ensures a secure and private experience. For those looking for a transparent, user-friendly credit card that rewards everyday spending while offering top-notch security, the Apple Card is an excellent choice.

How to Apply for the apple card

- Open the Wallet App: Ensure you have the latest version of iOS.

- Select Apple Card: Tap the “+” button in the Wallet app and choose “Apple Card.”

- Fill Out the Application: Provide your personal and financial information.

- Submit for Approval: Review and submit your application.

- Start Using Instantly: If approved, the card is available immediately in your Wallet app.

Disclaimer: You will be redirected to the official website.

No foreign fees

The Apple Card is a top choice for travelers, offering no foreign transaction fees. Whether you’re shopping abroad or making purchases in a foreign currency, you can use your Apple Card without incurring additional costs. This feature makes the card ideal for international use, allowing you to enjoy your travels without worrying about hidden fees.

Benefits Breakdown

| Feature | Details |

|---|---|

| Annual Fee | $0 |

| Rewards Rate | 3% Daily Cash on Apple purchases, 2% with Apple Pay, 1% on others |

| Welcome Bonus | None |

| Privacy Features | No data sharing for advertising |

| Foreign Transaction Fee | None |

DAILY CASH REWARDS

The Apple Card sets itself apart with Daily Cash rewards, a simple and instant cashback program. Earn 3% on purchases from Apple and select merchants, 2% when using Apple Pay, and 1% on other transactions. With no cap on rewards, you can enjoy continuous benefits while making everyday purchases.

How to Improve Your Credit Score to Get Approved for the APPLE Card

To increase your chances of approval for the Apple Card, consider these tips:

- Pay Bills on Time: Late payments can negatively impact your credit.

- Monitor Credit Utilization: Keep your usage below 30% of your credit limit.

- Limit Credit Applications: Multiple applications in a short time can lower your score.

- Review Your Credit Report: Check for errors and correct any inaccuracies.

- Build a Strong Credit History: Maintain older accounts to show consistent credit use.

By maintaining a good credit profile, you can unlock the full potential of the Apple Card.

FINAL CONSIDERATIONS

The Apple Card is a groundbreaking credit card that redefines the user experience by combining technology, simplicity, and transparency. Its no-fee structure, including no foreign transaction fees, and Daily Cash rewards ensure users can earn on everyday purchases without worrying about extra costs. The card’s seamless integration with Apple Pay makes it particularly appealing for those who already use Apple’s ecosystem, offering a streamlined and rewarding payment experience.

While the card’s highest rewards are earned on Apple purchases and Apple Pay transactions, its emphasis on privacy and security sets it apart. Features like dynamic security codes and a commitment to not selling user data ensure peace of mind for cardholders. The Wallet app enhances convenience by providing real-time spending insights, payment tracking, and financial management tools, making it a modern solution for digital credit card users.

For tech-savvy individuals who value simplicity, transparency, and rewards within the Apple ecosystem, the Apple Card delivers exceptional value. Its combination of innovative features, user-friendly design, and focus on privacy make it a compelling choice for those seeking a hassle-free and rewarding credit card experience.